What happens if you die without a will? Dying without a will can have a tremendous and far-reaching impact. Canadians are often far too unaware of the implications of dying without a clear plan for their estate.

If you don’t understand what this can mean for your estate and your family, you could put off this critical task of estate planning until it’s too late.

In today’s post, we’re going to cover some of the potential consequences of dying without a will.

What happens if you die without a will?

If you haven’t already written a will and created an estate plan, this information should provide the impetus for doing so.

If you have completed your estate planning tasks, these four important realities will reinforce their importance and may cause you to reexamine what you already have in place.

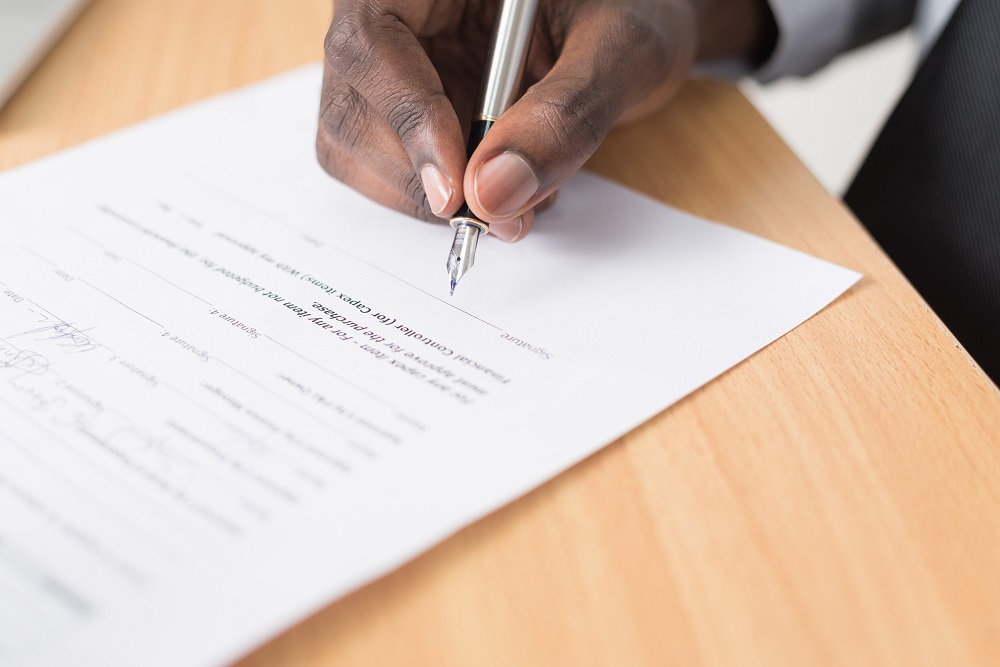

1. You surrender control

Without proper estate planning before you die, you lose control of what happens to your estate upon your death. This could also include responsibility of your children.

Laws vary by province and territory, but the government will be tasked with assigning someone to settle your estate. Understandably, this isn’t the most desirable option for many people who would prefer having someone they know and trust charged with this important job.

If you have children who are minors, the government could also decide who raises them. For most parents with young children, this is the most serious and critical consideration for what will happen after they die.

2. Your family may get less money

Perhaps you intended to leave a certain amount of money to each child, but you died before you had a chance to write your will.

Some or all of the money that could have gone directly to your beneficiaries may end up being used to settle your estate, including covering taxes and other fees.

If you’ve properly planned your estate, the likelihood of your beneficiaries receiving their intended money and property is drastically increased.

3. Your charitable intentions could be overlooked

Another consequence of dying without a will is your charitable giving plans going unnoticed and unfulfilled.

If your philanthropic intentions aren’t clearly outlined in your will, chances are your money won’t end up going to the charities you hoped they would.

Are you planning on leaving your entire estate to charity? Here’s what you should know about this decision.

4. It can cause tension (or worse) within your family

If upon your death your intentions for beneficiaries weren’t properly declared, a conflict over your estate could begin within your family.

It’s something we see on TV and in movies all the time, but this kind of conflict is a harsh reality.

All too often after the death of a loved one, tension or disagreements over estate planning are started between otherwise peaceful families. In my years of experience as a financial planner, I’ve seen countless families go through this.

Avoiding financial disagreements after your death is possible if you’ve taken the proper steps to settle your estate before passing away.

If you’d like to learn more about avoiding financial disagreements after your death, you’ll find this post helpful.

Maybe you’ve put off the task of writing a will and planning your estate because it doesn’t seem urgent or important right now. Maybe it seems like too big of a task to take on.

But these four realities of dying without a will should emphasize that estate planning should be a priority that’s moved to the top of your list.

Enlisting legal help and financial advice from lawyers, financial planners or accountants is strongly encouraged before taking any steps in estate planning. It can also make the process seem less daunting.

Did you find this article useful? Here are three more you might also enjoy:

Have you thought about what you want your legacy to be?

Who do you want to benefit from your money when you are no longer here?

Estate planning with your loved ones

0 Comments