Taking the mystery out of financial planning for life, not the Magic.

When it comes to financial planning, there are four things we can do with our money. In its simplest form, money is something we can can Owe (debt and taxes), Grow (savings and investments), Live (spending, lifestyle), and Give (charity and family).

Everything we do with our money can fit into one of these four quadrants, and the focus should be placed on maximizing your return on life.

As a financial planner, I use these tools in my Financial Life Planning Process as they allow me to incorporate my client’s values in this process. By encouraging clients to share their personal finance stories, I gain a better understanding of their relationship with money and what’s most important to them. This helps direct me in best allocating their money into these four areas.

For example, if your current annual income is $100,000, I take that information plus dollar amounts in the four areas (owe, grow, live, give) to see what percentage of your income is going where.

1. How much you pay in income taxes plus debt payments (OWE)

2. How much you are setting aside for savings and investments – cash buffer/emergency fund, retirement savings, education savings (GROW)

3. How much are you spending for your lifestyle – food, groceries, dining out, entertainment, gas in your car, car repairs, gifts (LIVE)

4. How much money are you giving to family members and/or your favourite charities (GIVE).

This gives me a starting point of where you’re at now. Then I look at where you’d like to be, both now and in the future. This process provides the opportunity to discuss what you would like to change and how you can make those changes in order to shift the amounts from one area to another. For example, if you can reduce your debt you’ll spend less money on paying off what you owe, and can instead shift those funds to savings, lifestyle, or both! Perhaps you want to give more to charity and pay less in taxes? These financial goals cannot be reached reached overnight, so the first step is identifying the changes you must make in order to have that happen. What strategies can we use to pursue and achieve those goals?

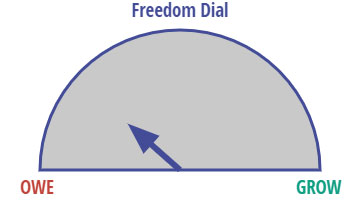

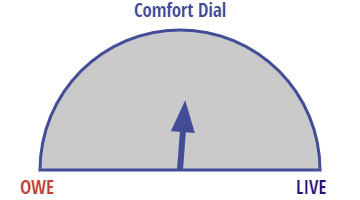

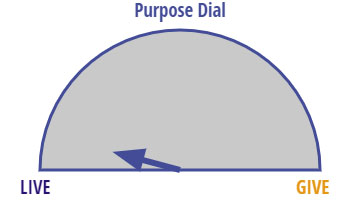

There are three dials that Mitch has developed to demonstrate some very important points and considerations within this model.

The first one is the Freedom Dial: The more you owe the less freedom you have in your life and the more you grow your money the more freedom you have in living your life.

The second one is the Comfort Dial: The less you owe the more you can enjoy your life while living it to its fullest.

The third one is the Purpose Dial: What happens over time is this; what gives people purpose and meaning is being less focused on lifestyle and more focused on helping family members, and giving to charity; making a difference in the world and in the lives of others.

Using visuals and models like these helps people gain a much better understanding of their current personal finance situation, along with where they would like to go as part of their financial life planning journey. Figuring out how you are going to get there includes accessing the financial tools available to determine what’s going to work best for you.

We encourage you to think about these concepts; What are you trying to accomplish from your life? What is important to you? What do you need to change in your life to make your dreams a reality?

Written by Betty-Anne Howard with Mitch Anthony. We both believe strongly in empowering people, families and organizations by providing easy to understand information so you can make informed decisions about your financial future.

0 Comments