Download a FREE copy of The Couple’s Financial Intimacy and Pleasure Guide – A chapter from my recently published book, EMERGE. Enjoy your free chapter!

Did you know that we are much more apt to change our behaviour at specific times of the year or significant dates in our lives – like our birthdays, the first day of spring, the beginning of the new year, or when we move to a new community?

Wharton Professor and researcher Katy Milkman describes this behaviour which she calls “The Fresh Start Effect” in her book How to Change: The Science of Getting from Where You Are to Where You Want to Be. Her work found that “fresh starts” on specific event dates can enable people to be more effective at setting and achieving behavioral-changing goals.

So let’s consider that Valentine’s Day could be the perfect time for a fresh financial start with your partner!

Many of us who are in coupled relationships celebrate and give gifts on Valentine’s Day such as chocolates, roses, or diamonds. We hopefully receive these gifts with a great deal of gratitude and appreciation for the thought that went into them. Perhaps a dinner out is part of our celebration for our years spent together with our partners or spouses. Some of us also like to celebrate our years of friendship with others.

But who in their right mind would want to think about any underlying conflicts or stressors that exist in our relationships on Valentine’s Day?

Financial Stress = Relationship Trouble

The reality is, we all experience some tension when it comes to money in our relationships, and that stressor can hinder the intimacy we would like to be experiencing. Our differing money mindsets and personalities mean that we can find ways to enhance our relationships by focusing on the positive aspects of our differences or we can allow those differences to detract from our love, tenderness, and meaningful connection.

Ultimately you get to choose which direction and path you want to take – will it be pleasure or pain? If it’s primarily stress and strain right now wouldn’t some pleasure help turn things around?

The journey towards financial intimacy and pleasure can begin on February 14th, with a fresh start. It only takes one first step, the decision to begin that journey together.

The Love Connection

According to Brene Brown in her excellent, just recently released book titled: Atlas of the Heart: Mapping Meaningful Connection and the Language of Human Experience love is difficult to narrow down into a simple definition. I like how she describes love because it highlights that love is a dynamic process requiring our attention and demands that we also love ourselves.

“We cultivate love when we allow our most vulnerable and powerful selves to be deeply seen and known, and when we honor the spiritual connection that grows from that offering with trust, respect, kindness, and affection. Love is not something we give or get; it is something that we nurture and grow, a connection that can be cultivated between two people only when it exists within each one of them – we can love others only as much as we love ourselves”.

We also know that the opposite of love can bring with it heartbreak and sorrow. This is why it’s imperative to ensure you are finding ways to enhance your love, especially when it comes to your relationship with money.

The 4 Barriers To Financial Intimacy and Pleasure

Let’s take a closer look at the barriers or hurdles we’ve constructed throughout our relationship that are getting in the way of our ability to work towards our goals, and the strengths we each have to build on this foundation of our relationship.

In my forty years of working with couples as a financial life planner, couples counselor, addictions specialist, and sex therapist, I’ve had extensive first-hand experience with how people communicate and fall in and out of love with each other. Unfortunately, in my work, I often encounter barriers that make it difficult for people to get closer to those they love.

1 – Words Can Separate Us

Within our relationships, we speak different languages! A bold statement considering we likely both speak English, French or Spanish or whatever shared language we use. But our language differences come from our words having very different meanings, depending on our gender, family history, culture, social circle, and life experiences. These differences create challenging communication barriers between us. The meaning we give to the words we use has a profound impact on communicating with each other and understanding and sharing purpose.

2 – Communication Problems

Have you ever heard that the message the receiver receives is rarely the message the sender is sending? This saying epitomizes and summarizes the challenges we face when trying to communicate with each other. In other words, I may be listening attentively to what you’re saying; however, I’m also using my filters to interpret what you’re telling me, and those filters skew my understanding. Add to that the emotionally charged topic of money, and you can see where problems begin, grow, and become complicated.

3 – Relationship Stages

Relationships go through different phases. These phases are a natural process in relationship development, and each stage has specific characteristics associated with that particular point in our relationships. The attraction stage can lead to the conflict stage and then the mature stage, each with its own stresses and difficulties. In my book chapter The Couples Guide To Financial Intimacy and Pleasure I describe the different stages and what barriers they create, and you can download that here.

4 – Money Mindset and Money Personalities

We all have very different ways of looking at money, reflecting our money mindset and our money personality. In addition, individuals can come from the same family and background and yet have very different approaches to money. What happens when a saver and security seeker partners up with a spender and risk-taker? These different mindsets and money personalities have the power to derail your relationship altogether.

How To Overcome Financial Intimacy Barriers

Once you understand the barriers, it’s vital to learn the specific steps you can take and the corresponding emotions and thoughts that go hand in hand with these steps.

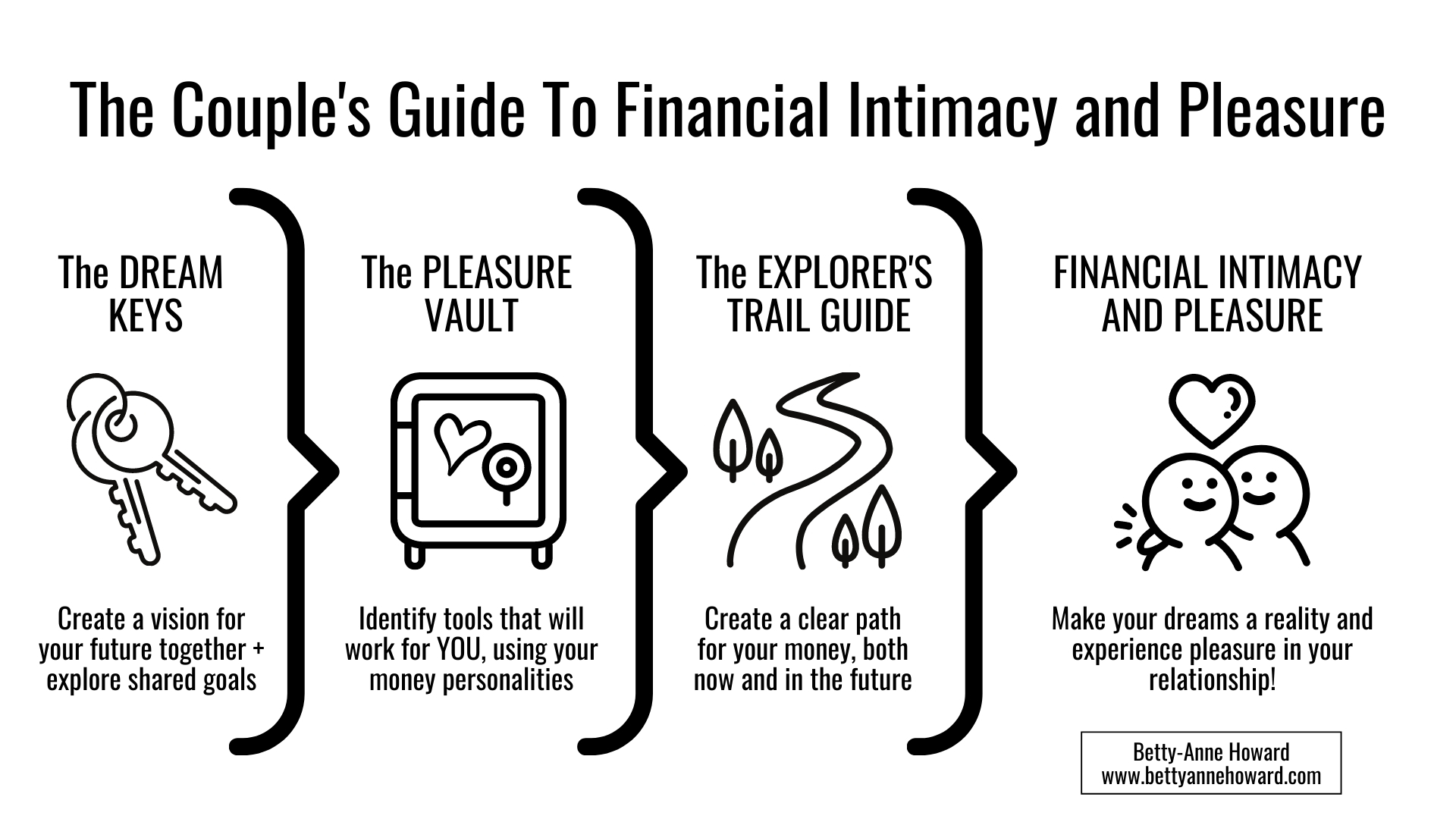

I’ve broken this down into what I call The Guide to Financial Intimacy and Pleasure, which is made up of The Dream Keys, The Pleasure Vault, and The Explorer’s Trail Guide. We use the word Explorer intentionally because any path to any type of intimacy requires curiosity, empathy, and compassion.

The Dream Keys

One of the best ways to get on the same page with each other and reignite the dreamer in you is to talk about your vision for the future. No need to get stuck or caught in the weeds, for now, much more important to discuss, explore and remind yourselves what your shared vision is for your future together.

You may have lost sight of that vision so it’s good to sit back, relax and use your imagination – especially if the dreams have been buried for a while – and remind yourselves what you want to accomplish together.

Perhaps you want to buy a house, move to a bigger house, buy a second property on a lake for your retirement, have kids, send your kids off to College or University, take a vacation, or celebrate your anniversary with a special event.

You are unlocking your dreams from wherever you may have stashed them to remind yourselves that you can work towards making these dreams a reality, one step at a time.

Often it’s good to recognize that you may have your own individual dreams and perhaps even your shared dreams aren’t shared at all, or your priorities differ. That’s okay. I once worked with a couple where one partner wanted to buy an airplane, a Cessna and the other had no interest in that nor in getting into a small plane! That worked because we set up different investment accounts for their differing goals and needs.

It’s helpful to explore where your dreams originated which gives you the opportunity to see if this is really what you want, or what someone else thinks you should have. We often take a closer look at this concept when we meet with couples because there are many layers of wants and needs along with how much our society, friends, and families have influenced us without even realizing it.

What’s most important for you as a couple is to discuss your dreams together (not fight about them) and start to focus on the ones you share. This meaningful conversation can be facilitated by an experienced communicator who is a Financial Planner. That way you have some objective advice and observations to help you with this starting point.

Most couples I work with are excited and enthusiastic about taking the next steps towards these goals because this experience provides them with clarity. Very few of us take the time to have this discussion throughout the day with each other and we are usually too tired to take on this task over the weekend. By making the commitment to engage in this process with a Financial Planning Guide you are setting yourselves up for success.

The Pleasure Vault

Step 2 of the journey, the Pleasure Vault, is the myriad of tools available to you that will allow you to take this journey together with confidence and grace. The problem most people face when it comes to financial tools is that they don’t understand the tools available to them, or how they can be used.

People feel overwhelmed with all the information available online or in books and inevitably end up wondering, what will work for us? Finding and using the right tools for you as a couple is both an art and a science. There is no one size fits all solution. The right fit tool(s) will be based on your individual money mindsets and personalities.

We take the time to help you understand how the tools work and how best to use them so you can start to feel more and more comfortable and confident in using them.

So what are these tools? We usually start with the ones that will help build back up the foundation for your lives together, and then we focus on the ones that will support you in your goals towards making those dreams we talked about, a reality.

There is no “one size fits all” tool available to you because even setting up investment accounts and all the options available to you like RRSP’s RESP’s, RDSP’s, Pension Plans, TFSA’s and so on don’t necessarily bring with them a straightforward answer to how much to allocate, which account to use, and how often to contribute.

The answer for your particular situation comes from your dreams while examining which tool or vehicle will get you where you want to go in the time you want to get there. For example, if you want to go to Ottawa from Kingston you can take a plane, hike the Rideau Trail, take a bus, or drive in your car. The mode of transportation that will work best depends on many different factors, just like your money and the investment vehicles we can use.

The Explorer’s Trail Guide

Once you get to this place in your journey, you may be asking yourselves, how are we actually going to do this? The how is in the Explorer’s Trail Guide that pulls together your dreams and the tools – the results are the plan.

I’m sure you’ve heard the saying if you fail to plan you plan to fail. Not that a plan is without its challenges as life can throw curve balls our way quite often (for example, this pandemic). That’s why we use the term “explorer” in our guide because you will be learning more about each other as you go on this journey and it’s important to enter onto this path with a sense of wonder and exploration.

According to Brene Brown, “human emotions and experiences are layers of biology, biography, behavior, and backstory.” The goal on this trail accompanied by the tools you’ve brought along with you is to form a stronger connection with each other which ultimately leads to greater and greater pleasure in your relationship.

Connecting with each other requires more than just living under the same roof. It is, and I love Brene Brown’s definition, “the energy that exists between people when they feel seen, heard and valued; when they can give and receive without judgment; and when they derive substance and strength from the relationship.”

We all need a guide to help us with making these changes in our lives to enhance our connections with each other and that includes our relationship with money. A Financial Planner skilled in this area can be that guide.

If you would like to dive deeper into these concepts, I invite you to download The Couple’s Guide To Financial Intimacy and Pleasure, here below:

Using Valentine’s Day for a fresh financial start

Taking a fresh start to look at your relationship with your partner and your finances can be very rewarding. Katy Milkman’s research shows that we are much more inclined to be willing to engage in this fresh start when it includes positive reinforcement and outcomes. We need to experience some benefits or pleasure in order to move forward on this path.

The pleasure factor has always been a part of how we see what we do. My philosophy is, “let’s make this experience enjoyable so you’ll want to come back and keep discussing your financial future”.

In fact, I even wrote a song about pleasure and fun with money with a lot of help from Trevor Strong from the Arrogant Worms, and you can have a listen here. We created this song when I went to audition for The Dragon’s Den a few years ago, but that’s a story I’ll share with you another day!

I want to end this look at financial intimacy and pleasure with the concept of hope, which was another great find from Brene Brown’s book. I was thrilled when I read her definition of hope because it’s so closely aligned with the work I do.

According to her, the experience of hope has three parts to it, the first is to have the ability to set realistic goals (I know where I want to go), the second is having a plan and therefore knowing how to get there, and the third is finally believing in ourselves, knowing that we can do this!

“We need hope like we need air.” Brené Brown

We believe that Valentine’s Day is the ideal time to have hope and begin your own fresh start when it comes to enhancing your financial intimacy and pleasure.

Love is in the air!

Download a FREE copy of The Couple’s Financial Intimacy and Pleasure Guide – A chapter from my recently published book, EMERGE. Enjoy your free chapter!

__________________

Enjoyed this article? You might also enjoy:

Giving and Receiving an Inheritance: Our Guide To What Works and What Doesn’t

How To Magnify Your Charitable Gift Giving

Why You Need A “Giving Plan”

0 Comments